2022 Proxy Voting Guidelines

Greater board accountability for diversity, community safety, and climate change are highlights of the SHARE 2022 Proxy Voting Guidelines.

View PDF

Greater board accountability for diversity, community safety, and climate change are highlights of the SHARE 2022 Proxy Voting Guidelines.

View PDF

A growing movement of Canadian businesses and organizations are announcing Reconciliation Action Plans (RAP). Learn more in this recording from the 2022 SHARE Investor Summit.

View Page

In 2022, the stark realities of climate change, global public health crises, and racial and income inequality are ever-present, and we can't diversify our way out. Learn more in this recording from the 2022 SHARE Investor Summit.

View Page

Learn how creative leadership is paving the way for meaningful collaboration towards reconciliation in this recording from the 2022 Summit. Featuring CCAB and TMX Group.

View Page

SHARE mobilise les billions de dollars d’actifs détenus par les investisseurs

institutionnels canadiens pour promouvoir une économie plus durable, inclusive et productive. Nos priorités d’engagement pour 2022 comprennent la transition climatique, le travail décent et la réconciliation.

SHARE mobilizes the trillions of dollars in assets held by Canadian institutional

investors to promote a more sustainable, inclusive, and productive economy. Our engagement priorities for 2022 include the climate transition, decent work and human rights, and reconciliation.

With input from 48 Canadian investment managers and advisors, RRII developed a framework to describe actions that investment managers can take to advance reconciliation and Indigenous rights recognition.

View Page

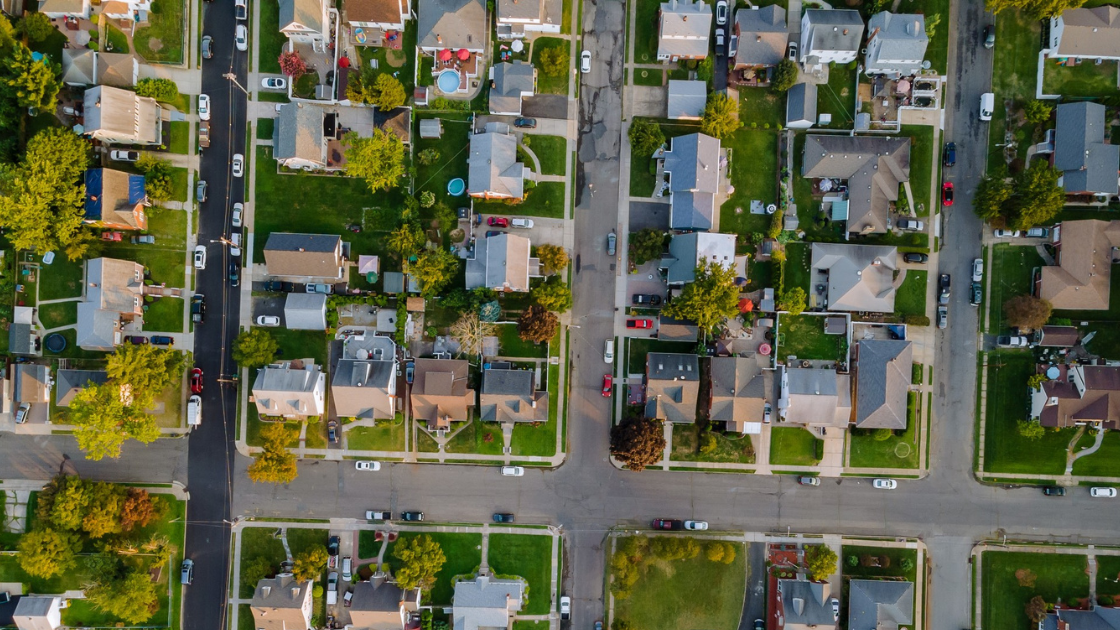

This webinar was an opportunity for investors to learn about how the financialization of housing is unfolding in Canadian cities, consider why housing affordability is an issue for investors and discuss what investors can do to begin addressing concerns regarding housing affordability in their portfolios.

View Page

As the housing crisis deepens, the growing presence of institutional investors in the rental real estate market – a phenomena often referred to as the financialization of housing – is coming under scrutiny. Housing affordability is an issue that investors must address in their portfolios.

View PDF

2020 marked SHARE’s twentieth anniversary. This past year, we rose to the challenge, mobilizing our network of institutional investors in support of a just recovery, building resilience, advancing racial justice and reconciliation and continuing our efforts to build a sustainable, inclusive and productive economy. Learn more in our Annual Report.

View Page

SHARE’s stewardship services help institutional investors become active owners by facilitating constructive shareholder dialogues with companies on key environmental, social and corporate governance (ESG) issues.

View PDF

This report reviews company disclosures using a broad set of indicators to measure progress in advancing reconciliation since the release of a benchmark report in 2017.

View PDF